Property Management Agreement

This is a contract in which you entrust the management of your property to a trusted person while you still have the ability to make decisions. This is in preparation for when judgment becomes difficult, such as in the case of dementia.

Voluntary Guardianship Agreement.

This is a contract in which a guardian is selected in advance and asked to manage property and provide support for daily life in case the person becomes incapable of making decisions in the future. A trial by the family court is required for the agreement to take effect.

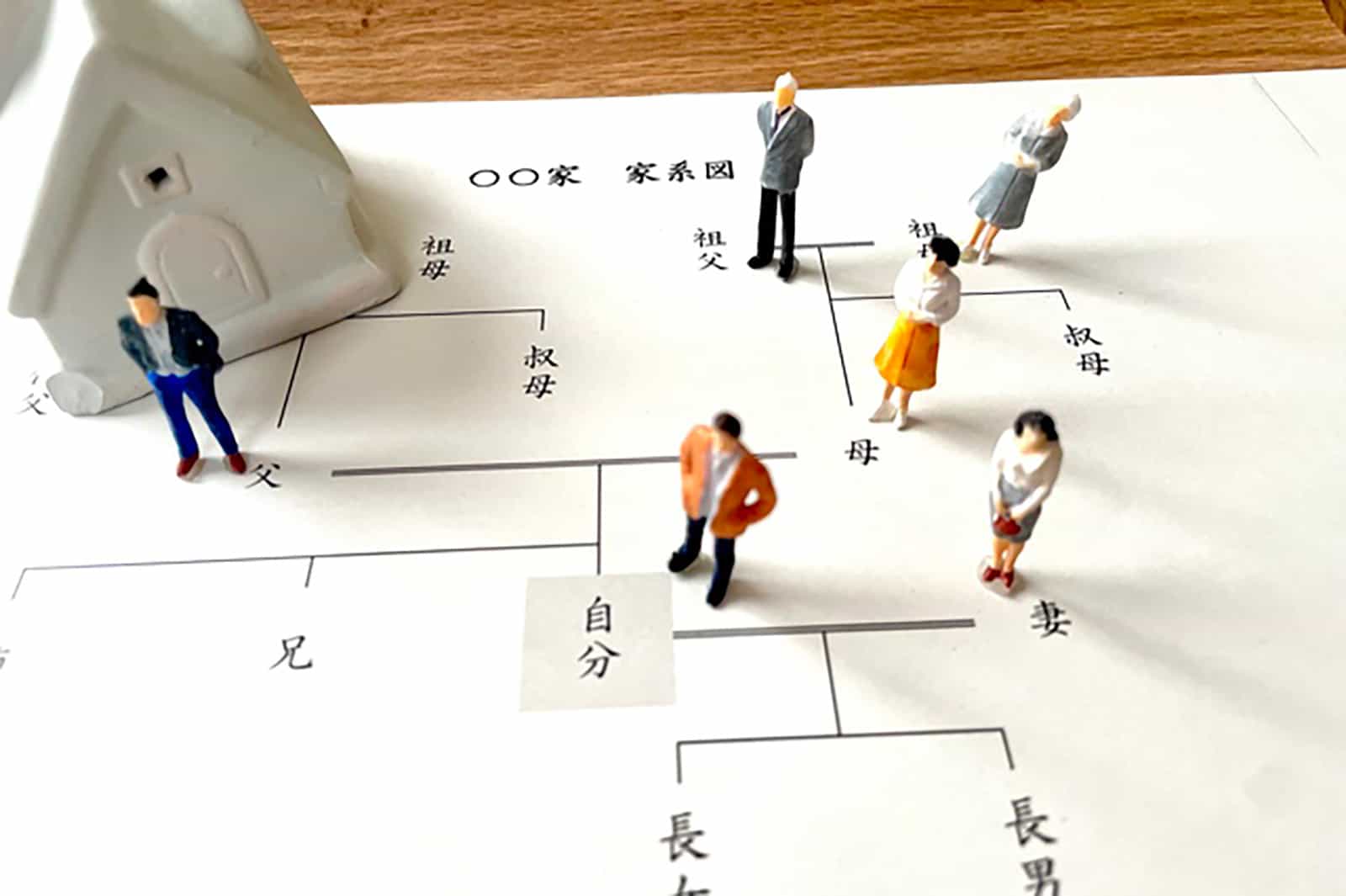

INHERITANCE

Inheritance

-

will

It is a legal document that describes how your property will be divided after your death.

Self-written Wills

This is a form of will in which the entire text is written in one's own handwriting. Since 2020, it has been possible to create an inventory of property on a computer.

The Legal Affairs Bureau established the "Will Custody System" in 2020.

A system that allows a will to be stored at the Legal Affairs Bureau, reducing the risk of loss or tampering.

Notarized Wills

A will prepared and kept by a notary, whose contents are legal and effective in preventing disputes. The presence of two witnesses is required.

Testamentary Trusts

It is a mechanism whereby an estate is placed in trust by will to a certain person or institution, and the trustee who receives the trust manages and distributes the property for the beneficiaries who are the addressees. This is effective when you want to stipulate how the property is to be used, rather than merely passing it on to the next of kin.

-

The Estate Division Agreement.

All heirs discuss and decide how the estate will be divided.

*"Contribution."

This is the portion of the inheritance that is recognized as specially increasing the inheritance due to the decedent's care or contribution to the family business.

*"Special Benefit."

If a person received a large gift or assistance during his or her lifetime, the amount of the gift or assistance is deducted from the inheritance and divided fairly.

-

Probate of wills

This is the procedure by which the family court confirms the existence and contents of a will. This is required for wills other than notarized wills.

Claim for the amount of the disgorgement.

This is a system whereby heirs whose minimum inheritance share (remainder share) is violated as stipulated by law can claim the deficiency.

※Since the issues of filing and paying inheritance taxes and inheritance under the Civil Code are not similar, whether or not inheritance taxes can be paid is not the same as whether or not the inheritance can be resolved amicably.

For filing and paying inheritance taxes, we can refer you to our affiliated tax accountant firm.

In 2024, inheritance registration became obligatory. For inheritance registration, we will cooperate with the affiliated judicial scrivener's office.

Reservation, Inquiry,

Online Consultation

and we want to work with them in their business and in their lives.

We are committed to doing our best with such passionate thoughts in mind.

Please feel free to contact us for a consultation.